Microsoft's iPhone Mandate, Hong Kong's Uber Regulation, and More

Microsoft's China Staff Switch, Hong Kong's Uber Rules, and Logitech's Board Drama

Microsoft Tells China Staff to Swap Androids for iPhones - Bloomberg

Microsoft employees in China can only use iPhones for work from September.

Hong Kong Unveils Plan to Regulate Uber 10 Years After Launch - Bloomberg

Hong Kong plans to regulate ride-hailing services, potentially limiting the scope of Uber Technologies Inc.

Authorities intend to license platforms such as Uber and adopt tougher penalties for rule breaking

Taxi services would be improved through the introduction of so-called premium fleets

Currently, there are only 1,500 hire-car permits available for Uber, and there are no plans to increase the quota

Complaints against taxis lodged with the government last year rose 75% compared with 2022

The Transport Department will conduct a study on commuter needs to shape the new planned regulatory regime

Logitech Snubs Its Founder, Denies Request for a New Chair Vote - Bloomberg

Logitech has denied founder Daniel Borel’s request to replace its board chair at the company’s shareholder meeting on September 4.

Borel had pressed the company to introduce a proposal to replace the chair, Wendy Becker, with Guy Gecht, who already serves on the board.

Broadcom Sells $5 Billion of Bonds to Refinance VMware Loan - Bloomberg

Broadcom is borrowing $5 billion in the US investment-grade bond market to refinance a portion of the loans secured for its acquisition of VMware Inc.

The company is selling debt in three parts, with the longest tranche expected to yield 0.95 percentage point over Treasuries

Proceeds from the sale will be used to prepay term loans and for general corporate purposes, leaving at least $23.4 billion of debt that will still need refinancing

Bank of America Corp., BNP Paribas SA and HSBC Holdings Plc are leading the bond sale.

CyrusOne Inks $7.9 Billion Credit Line in AI Data-Center Push - Bloomberg

CyrusOne has secured a $7.9 billion line of credit to build more data centers.

The company will use the credit line primarily to fund development projects in the US.

How a Wall St. Law Firm Wants to Define Consequences of Gaza-War Protests - New York Times

Sullivan & Cromwell, a prominent Wall Street law firm, is requiring job applicants to explain their participation in protests related to the war in Gaza.

The firm is working with a background check company to scrutinize students’ behavior for statements or actions about the conflict, including explicit instances of antisemitism and pro-Palestinian student groups.

Participation in an anti-Israel protest, on or off campus, could be a disqualifying factor for job applicants, even if they did not use problematic language or were involved in a protest where others did. The policy is seen as an effort to silence criticism of Israel on campus and to paint all protesters as equivalent to those who have been heckling or threatening Jewish students. b

Critics argue that the policy is a way to silence speech about the war and discourage Muslims and Arabs from discussing their views on Israel and its actions. c. Some private employers in the US can hire whom they want, with only a few restrictions meant to prevent discrimination. d. Some elite rivals on Wall Street are considering adopting similar rules. e.

Multibillion-Dollar Fraud Trial Against Archegos Founder Nears Its End - New York Times

Bill Hwang, the founder of Archegos Capital Management, is facing trial for securities fraud and racketeering charges in Manhattan.

Hwang allegedly defrauded banks and traders by artificially inflating stock prices to increase the size of his firm and then causing its collapse in 2021

The collapse caused billions in losses for Wall Street banks and wiped out much of Hwang’s personal fortune

Mr. Hwang is charged with 11 counts and could spend the rest of his life in prison if convicted on all counts

Prosecutors alleged that Hwang and his co-defendant, Patrick Halligan, misled banks about the firm’s overall footprint in the market

Andrew Thomas, a prosecutor, accused Hwang of defrauding banks by using sophisticated derivatives and borrowed money to inflate his firm’s holdings

Lawyers for Hwang argue that his client’s high-risk trading was not manipulative and was not criminalized only because it caused losses for the banks he had lent billions of dollars to.

Boeing Plea Deal Involving 737 Max: What to Know and What Comes Next - New York Times

Boeing has agreed to plead guilty to conspiring to defraud the federal government and agree to an independent monitor, three years of probation, and financial penalties.

The deal may help put to rest a federal case stemming from two fatal crashes of Boeing’s 737 Max planes in 2018 and 2019

However, the deal is not the final word on other legal challenges and operational problems related to the 737 Max plane

Families of victims of the crashes have expressed disappointment with the way the Justice Department handled the case against Boeing

A formal agreement is expected to be filed in a federal court in the coming days, which many families strongly oppose

If the judge sides with the families, a monitor will be chosen by an independent committee, with the final decision made by the deputy attorney general

Trials in civil cases filed against Boeing by some families are scheduled to begin later this year.

Skydance Reaches Deal to Merge With Paramount - New York Times

Paramount and Skydance have agreed to merge, creating a new era for CBS, Nickelodeon, and the film studio behind Top Gun and Mission: Impossible franchises.

The deal has been approved by Paramount’s board and is a turning point for the Redstone family, whose fortunes have been intertwined with the rise and fall of the traditional entertainment industry.

Many of Paramount’s other investors have expressed concerns about the deal, saying it would enrich Paramount’s chair, Shari Redstone, at the expense of other shareholders. - The merger has a 45-day window to see if a superior deal can be found, and if it closes, it will anoint a new mogul in Hollywood. David Ellison, son of Oracle founder Larry Ellison, will become the top power broker at Paramount. The full value of the merger was not immediately clear due to the complex nature of the deal. Paramount is acquiring National Amusements for roughly $1.75 billion in a deal that leaves the studio and its backers in charge of a media empire that includes film, TV, and news properties.

Meet David Ellison, the CEO of Skydance and Paramount’s New Owner - New York Times

David Ellison, the CEO of Skydance Media, has merged with Paramount to create a media empire that includes CBS, MTV, and the Paramount movie studio.

He is the son of Oracle founder Larry Ellison and has been involved in producing big-budget films like “Mission: Impossible” and “Star Trek Into Darkness.”

His family has considerable influence in Hollywood, with his sister and sister-in-law also being involved in showbusiness

Ellison has discussed working with another major entertainment company on a streaming joint venture in the United States

Paramount’s controlling shareholder, Shari Redstone, is enthusiastic about the potential benefits of the deal and plans to add tech capabilities to the combined company

Mr. Ellison has not publicly laid out his plans for Paramount publicly, but has discussed them with a special committee of the company’s board months ago

Two people familiar with his pitch to Paramount’s board are optimistic about the success of the merger.

Australia-led report names Chinese state-backed group as cyber hacker - Financial Times

A former employee of the World Economic Forum has sued for discrimination.

The employee alleged that she was denied professional opportunities due to her race and gender.

News updates from July 8: Biden tells congressional Democrats he will stay in race; Boeing to plead guilty in 737 Max case - Financial Times

The US SEC is rethinking proposed rules on liquidity and pricing for mutual funds in a victory for asset managers

The move comes after a federal appeals court ruled that the SEC had overstepped its authority on proposed rules involving private fund disclosures

Nato allies are not seeking reassurance about US President Joe Biden’s health for the 75th Nato summit

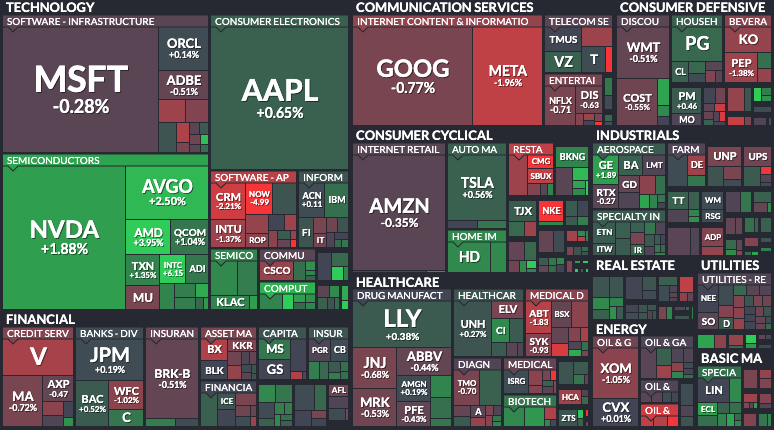

US stocks are hovering near record highs, with the S&P 500 hitting an intraday high earlier in the session

Fed chair Jay Powell is due to address Congress on Tuesday and Wednesday, potentially providing traders with an opportunity to glean hints on the future direction of interest rates

UK Conservative party chair resigns after the party suffered its worst defeat in history in last week’s election

Sequoia Capital’s former China unit has raised a new $2.5bn start-up fund, defying a fundraising freeze that has hit rivals

Sequoia Capital’s former China unit raises new $2.5bn start-up fund - Financial Times

Sequoia Capital’s former China unit, HongShan, has raised Rmb18bn ($2.5bn) in a renminbi fund to invest in technology start-ups in the country.

The fund is the largest fundraising by a privately owned VC firm in China in the past year and is backed by the Hangzhou city government and private and state-owned insurance companies.

Starting-up companies in China have been hit by economic and property crises and regulatory crackdowns, making it difficult for VC firms to compete with established Chinese tech investments. - The new fund is smaller and more easily invests in sensitive technologies, which could pose a challenge for traditional VC partners such as US limited partners. financiers have been cautious about investing in sensitive industries due to proposed rules that would stop US investment in Chinese technology with military uses.

Terry Smith defends move to shun US technology stock Nvidia - Financial Times

Investment manager Terry Smith’s Fundsmith Equity portfolio avoided US technology giant Nvidia due to scepticism about its growth forecasts

The fund lagged behind its benchmark in the first half of the year as it failed to benefit from a surge in Nvidia’s stock

Smith’s portfolio includes stakes in Apple, Meta, and Microsoft, but he chose to avoid chipmaker Nvidia

Failure to hold large tech “megacaps” like Nvidia, Microsoft, Amazon, Meta and Apple contributed to the fund’s underperformance

In the six months to the end of June, the fund returned 9.3% compared with the MSCI World Index’s 12.7% in sterling terms

Top-performing stocks in the fund included Novo Nordisk, Facebook owner Meta, Google owner Alphabet, and medical devices company Stryker.

Delivery Hero shares slide on concerns over EU fine - Financial Times

Delivery Hero, a German online food delivery group, faces a potential fine from the EU for anti-competition violations of more than €400mn.

The potential fine is for alleged anti-competitive agreements to share national markets, exchanges of commercially sensitive information, and no-poach agreements, among other things. The company plans to significantly increase its provision to €186mn after inspections by the EU in July 2022 and November 2023. The EU has been probing companies it suspects are breaking competition rules, including online delivery groups, for a long time. Companies found guilty of breaking EU rules face fines of up to 10% of their global turnover, up to €4bn in the past five years.

Analysts from Bernstein say the potential fine could potentially delay the group’s trajectory to positive free cash flow and could have a limited short-term impact on the stock.

For AI Giants, Smaller Is Sometimes Better - Wall Street Journal

Tech giants and startups are using small or medium language models to make AI software cheaper, faster, and more specialized. These models are trained on less data and often designed for specific tasks. Smaller models cost less than $10 million to train and use fewer than 10 billion parameters. Microsoft, Google, and Apple have all released smaller models this year. OpenAI recently released a version of its flagship model that it says is cheaper to operate. Businesses and consumers are looking for ways to run generative AI-based technology more cheaply. Small models can answer questions for as little as one-sixth the cost of large language models in many cases. Fine-tuning small models on specific sets of data allows them to perform as effectively as large models at a fraction of the cost.

In an Era of Fakes, How to Know When Someone Online Is Real - Wall Street Journal

Personalized schemes to dupe internet users are on the rise

The single best step to determine someone’s identity online and protect yourself is to slow down

Tech companies are beginning to help, with Google, LinkedIn and Bumble introducing features to detect suspicious messages and users

Guidelines for operating online are changing, some old rules still apply

Before transferring funds, ask for your prearranged secret word.

Sam Altman Startup Names Former X Executive as First Head of Privacy - Wall Street Journal

Tools for Humanity has appointed Damien Kieran as its first head of privacy as the company faces regulatory scrutiny over its Worldcoin venture. Kieran left his job as chief privacy officer at Twitter after Elon Musk’s takeover of the social-media platform.- Worldcoin lets users download a wallet app that supports a digital identity known as World ID, which scans people’s eyes in exchange for cryptocurrency tokens.

Kieran faces the task of liaising with regulators globally and addressing concerns over how Worldcoin handles biometric data, which has raised eyebrows in countries such as Spain and Germany.

The Bavarian State Office for Data Protection Supervision launched a review of Worldcoin last year, citing the high sensitivity of the biometrically data it processes. Worldcoin tokens are distributed to users in countries where they are legally available, and nearly 6 million users across more than 160 countries have signed up for World ID.

How the Kindle Became a Must-Have Accessory (Again) - Wall Street Journal

TikTok’s literary subculture, BookTok, is giving e-readers the Stanley cup treatment. Kindle has become the gadget of choice among the community of book lovers. Kindle sales have grown in double-digit percentages for each of the past two years and are on track for similar gains this year. People under 45 are Kindle’s fastest-growing customer segment. BookTokkers share reading habits, book clubs, book challenges, library cards, and people’s reading setups. Kindle Unlimited, Amazon’s $12-a-month subscription service allows customers to borrow more than four million digital books. Kindle newbies are driving the sales growth, with about 60% of Kindle sales growth coming from people who’ve never owned one of the devices before. Print and ebook sales rose during the pandemic but have declined since, according to market-research firm Circana. Library checkouts have jumped 75% since 2019, reaching 370 million ebooks last year.

Apple Watch Is Becoming Doctors’ Favorite Medical Device - Wall Street Journal

Doctors are using the Apple Watch as part of diagnosing and managing heart-rhythm disorders in patients.

The Apple Watch is being used informally in medical care despite other approved devices being available to track the same metrics

Dr. Rod Passman, a cardiologist and professor of medicine at Northwestern Medicine, is conducting a six-year, National Institutes of Health-funded study to determine if data from the Watch can be used to reduce the time spent on blood-thinning medications for atrial fibrillation patients

Passman has received an exception to FDA rules to use the Watch to alert patients who have already been diagnosed with the disorder that they are having an irregular heartbeat

Many doctors are encouraging patients to buy an Apple Watch to monitor stress levels and assess stress levels

Apple shipped about 40 million of its watches in 2023 alone, making it a popular choice for healthcare professionals

Compliance with medical-monitoring devices is an issue, but doctors are opting for the Watch due to its simplicity, affordability, and ubiquity

Patients wear the Watch for an average of more than 14 hours a day.